Sunbelt FCU Member Login :

The National Credit Union Administration (NCUA), a government administrative office, inspects the Credit Union for security and adequacy. The NCUA Share Insurance Fund guarantees a wide range of store accounts up to $250,000 so you can enjoy the harmony of your brain realizing your stores are safe.

Recently the NCUA started safeguarding credit association retirement accounts up to $250,000. Fundamental inclusion on other credit association accounts has likewise expanded to $250,000.

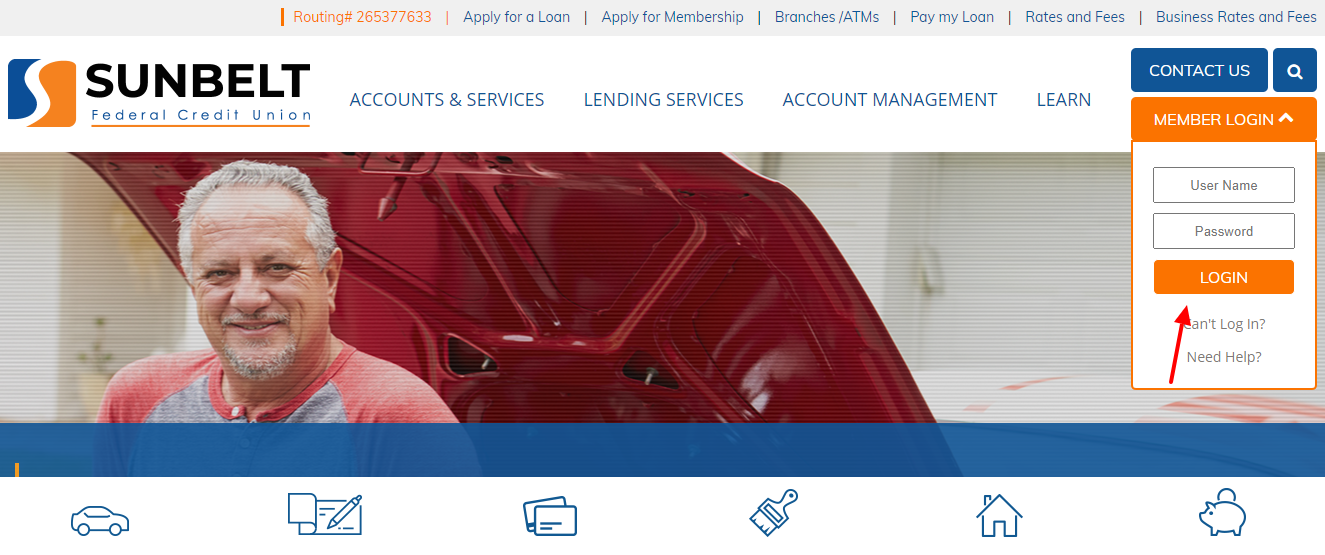

Sunbelt FCU Member Login:

- To login open the website www.sunbeltfcu.org

- As the page opens at top right click on the ‘Member login’ button.

- In the login drop down provide username, password hit on ‘Login’ button.

Reset Sunbelt FCU Member Login Details:

- To reset the login details open the page www.sunbeltfcu.org

- After the page appears in the login screen hit on ‘Can’t log in’ button.

- In the next screen provide username, date of birth, SSN or TIN, zip code click on the ‘Submit’ button.

Also Read : La Fitness Employee Login

Tips to Live Well After Retirement:

- Keep Up the Way of Life: At the least, most people need to keep up the way of life that they have gotten acquainted with. They need to guarantee that they will have enough to meet their day by day expenses without relying upon their developed kids or family members for monetary help. Most businesses will offer the chance for you to set up a 401k arrangement. Nonetheless, it is dependent upon you to augment the advantages of this exceptional sort of investment account.

- Make the Maximum Monthly Contribution: One of the most ideal approaches to expand your 401k advantages is to make the greatest month-to-month commitments that you can bear to make subject to the greatest permissible commitment. It’s implied that the more you can save now, the more cash will be accessible to you at retirement.

- Most Extreme Month to Month Commitment: Another advantage of making the greatest month to month commitment that you can stand to make, is that it decreases your annual assessment commitment. Recollect that your 401k commitments are deducted preceding tax assessment, which implies that you will wind up paying less duty every month relying upon the size of the 401k derivations. Which eventually implies that more is left to contribute towards your retirement store.

- Match Your Commitments: Finally, you should remember that your boss will coordinate with your commitments in the event that you contribute 3% or a greater amount of your yearly compensation towards your 401k. So once more, the more you contribute towards your 401k, the more your boss contributes which implies more assets for you at retirement. In the event that you offer not exactly the most extreme sum, you are denying yourself cash later on.

- Rewards: It is a smart thought to put any rewards or singular amount of endowments that you may get towards your 401k. The point is to augment your retirement reserve funds so the more you can take care of, the more prominent returns you can make and the bigger and quicker your retirement asset will develop.

- Focus on Your 401k Payments: In times of monetary difficulty, it very well might be enticing to decrease your month-to-month 401k commitments. This is anything but a smart thought and you will be in an ideal situation cutting costs in different territories. At the end of the day, penance today with the goal that you can live better tomorrow.

- Later Rewards: It is smarter to forfeit now to receive the rewards later. Recollect likewise that a few businesses will just match your commitments up to a specific level of your compensation. While it very well might be not difficult to spend your rewards on purchaser buys, it will be definitely justified to rather put that cash towards building an all the more monetarily secure retirement.

Sunbelt FCU Customer Support:

To get more information call on 601-649-7181.

Reference Link:

sunbeltfcu.calculators.finresourcecenter.com