Guidelines To Trustco Bank Online Banking Account Enrollment :

Your financial needs can be covered by a bank, and one of the reputed ones is Trustco. This is the public Bank in the United States of America. It was one of the oldest banks in the USA, which was founded in 1902 in New York City. This bank is now headquartered in Glenville, New York. This bank has more than 145 branches of which 87 branches are in New York City. The president and chief executive officer of the bank are Robert J. McCormick. The bank also has subsidiaries, such as Trustco Realty Corp, ORE Subsidiary Corp, and so on.

They provide personal and commercial financial services. According to the survey in 2009, the total net income of the bank is $28.12 Million USD. The slogan of the company is ‘Your Hometown Bank’ which is popular among the people of the United States of America.

Online Services by Trustco bank :

Savings Accounts

- Competitive interest rates

- Waivable monthly fees

- ATM card for certain accounts

- HSA option available

Checking Accounts

- $50 minimum to open

- Free debit card

- Waivable monthly service charge

- Interest-earning account available

Money Market Accounts

- Tiered interest rates based on account balance

- $2,500 minimum opening requirement

- $10 monthly fee is waived by a $2,500 balance

Certificates of Deposit

- Tiered interest rates based on term length

- $500 minimum deposit

- Interest compounds daily

- Terms from 30 days to five years

Individual Retirement Accounts (IRAs)

- Three types of IRAs: IRA CDs, IRA MMAs, and IRA Club account

Rates of Trustco accounts

Savings Account

- Minimum Deposit- $50. Fees $5 monthly service fee; waivable by maintaining a $200 minimum balance

- Current Terms and Rates- 0.25% APY.

Premier Checking Account

- Minimum Deposit- $50. Fees $5 monthly service fee; waivable by maintaining a $500 minimum balance or receiving a direct deposit each statement cycle

- Current Terms and Rates- 0.05% APY.

Money Market Account

- Minimum Deposit- $2,500. Fees- $10 monthly service fee; waivable by maintaining a $2,500 minimum daily balance.

- APY 0.10% to 0.85% .

Bank CDs

- Minimum Deposit- $500.

- No fees.

- APY 0.05% to 0.25%.

IRAs

Minimum Deposit

- IRA CD: $250

- IRA Money Market: $50

- IRA Club Account: $0

- No fees.

- APY 0.05% to 0.25%.

Enroll with Trustco :

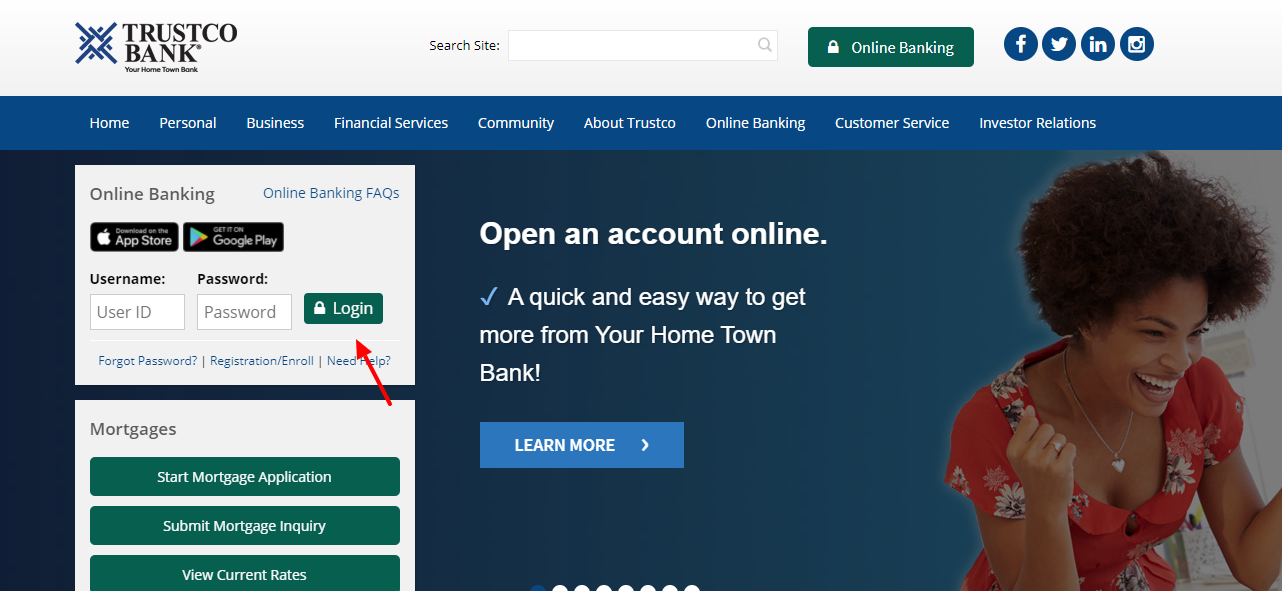

For this, you have to type the URL, www.trustcobank.com

- Here, at the middle left side of the landing page, you will get two blocks. The first one is the login box, and at the bottom inside the box, click on, ‘Enroll’.

- You will get a notification box at the upper side, click, ‘Ok’.

- You will be taken to a new tab, where at the middle enter,

- Account Number

- Account Type

- Enter Social Security

- Then, click on, ‘Continue’.

You need to follow the prompts after this to get enrolled.

Note: You have to note that Trustco Bank will never send you an email with a link to our login page or ask you for any personal information using email. Should this occur please disregard the email and contact us to look into the matter.

Logging into Trustco :

To log in, go to, www.trustcobank.com

Here, on the middle left side of the landing page, you will get two blocks. The first one is the login box.

Here, input,

- The username

- The set password.

- Then, click on, ‘Login’

This way you will be logged in.

Forgot login details

If you have forgotten the login information of Trustco, then, you have to go to the login box. Here, click on, ‘Forgot ID or Password?’.

- You will get a notification box at the upper side, click , ‘Ok’.

- In the next page, you will get a login box. Here, type,

- The login ID

- The set password

- Then, click on, ‘Sign in’.

- If you have forgotten the password, click on, ‘Forgot your password?’.

- For this you need to enter the login ID.

You have to follow the prompts after this and you will be able to get the details back.

If you click on ‘Need help’ you will be directed to the same page.

Also Read : Step by Step Process for Apply Presonal loan from Payoff

Benefits of Trustco online banking

- Get to review Transactions

- Check your balance Accounts

- Get to transfer fund between checking, savings and money markets accounts.

- Make Trustco loan payments by transferring directly from your checking or savings account.

- You will be able to view monthly e-statements

- Free Bill Pay

- Download information to Quicken and Microsoft Money.

- Get to request stop payments on checks.

- Get to reorder checks

- You will receive email and text alerts, for account balance, checks cleared, successful transfers and much more.

The points on Trustco accounts

- Get access to Trustco Bank accounts online by stopping into any of our over 140 Branch locations and speak to the Branch Manager.

- There is no fee to access your account

- All Pending transactions are hold(s) or credit(s) place on your account affecting your available balance. Some pending deposit amounts may include funds that are being held. Some pending debits may reflect a merchant hold on your account, which may or may not be the final amount posted to your account.

- Your access to online banking will be blocked in the event your Login ID or password is entered incorrectly on three consecutive access attempts. If this occurs, you have to call customer service at 1-800-670-4110

- You can reorder checks online

- Funds from electronic direct deposits to your account will be available on the day we receive the deposit. Funds from deposits of cash, wire transfers, and the first $5,000 of a day’s total deposits of cashier’s, certified, teller’s, traveler’s, and federal, state, and local government checks will be available on the first business day after the day of your deposit if the deposit meets certain conditions. For example, the checks must be payable to you and you must use a special deposit slip available from Trustco. The excess over $5,000 will be available on the ninth business day after the day of your deposit. If your deposit of these checks (other than a U.S. Treasury check) is not made in person to one of our employees, the first $5,000 will not be available until the second business day after the day of your deposit.

- Funds from all other check deposits will be available on the ninth business day after the day of your deposit.

- You can schedule transfers as one time transactions or as recurring events that repeat for a specified duration. Click the transfers tab, then click create a new transfer and follow the steps to complete the transfer set-up process.

- For suspicious email or fraud, you need to contact your local branch or call customer service at 1-800-670-4110

- Trustco Bank will never send you an email with a link to our logon page or ask you for any personal information using email.

- Bill Pay is a free and secure way to pay your monthly bills.

- Once enrolled in our online banking, simply login and click on the Bill Pay tab. Click the Open Bill Pay button and follow the steps to complete the set-up process. Your request for Bill Pay access will be confirmed by email within 2 business days.

- For any kind of Bill Pay assistance, you need to call 1-888-251-2534. A representative of the bank will be able to assist you with tracking your payment.

Find Trustco ATM or brunches

For this visit, www.trustcobank.com

Here, at the top menu panel, click on, ‘Find ATMs/Branches.

- In the next page, check the validation box on the middle left side.

- In the directed page at the middle, you need to type,

- Choose a Trustco Branch:

- Enter your Zip Code or City

- Search for all location

- Within the miles

- Then, click on, ‘Search’.

Note: If you are looking for a career with Trustco, you can go to www.trustcobank.com. Here at the top menu panel, you have to click on, ‘Careers’.

In the next page, you will get to see the positions available in the places listed.

Trustco Bank Customer Service :

To get in touch with Trustco, and if you have any query with online banking, you can call on the toll-free number, 1-800-670-3110. 8:00 am to 8:00 pm, Monday to Friday, and 8:00 am and 5:00 pm, Saturday.

Reference :