How to Login Ird Govt Nz Account:

Inland Revenue assumes a basic job in improving the monetary and social prosperity of New Zealanders. Inland Revenue gathers 80% of the Crown’s income just as gathering and dispensing social help program installments and furnishing the legislature with strategic guidance.

- Inland Revenue is responsive in meeting the changing and expanding desires for government and society

- They make it simple for clients to hit the nail on the head and difficult to miss the point

- society has certainty that fitting move will be made against clients who don’t go along

- progressively, paying duty is viewed as adding to society

- They are congenial, proficient, successful and effective.

Ird Govt Nz Login:

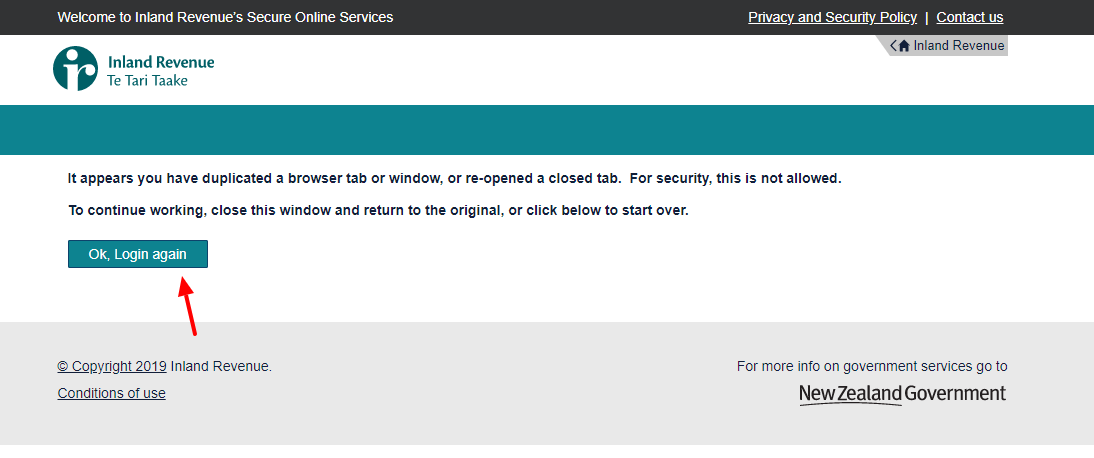

To login open the page, myir.ird.govt.nz/eservices/home

- After the page opens at the center click on, ‘Register for myIR’ button.

- In the next screen tap on, ‘Next’ button. Enter the information such as, IRD number, your name, date of birth, web name, and click on, ‘Next’ button.

- To login return to the previous page, click on, ‘Login to my IR’ button. Enter the require details, and tap on, ‘Login’ button.

- You can also login with RealMe.

- To recover user ID enter the IRD number, email, click on, ‘Email logon’ button.

- To reset password provide the information, IR logon, account associated email tap on, ‘Reset password’ button.

Frequently asked questions on IRD Govt NZ:

- Is this another expense?

New Zealand has a wide based GST that has consistently applied to products imported for utilization. The explanation behind not gathering GST on imported low-esteem products has been that the expenses of assortment at the outskirt made it illogical to do as such. The development in internet shopping from seaward retailers and the advances in innovation imply that gathering GST at the retail location is currently increasingly productive. It is assessed that the sworn off income from not gathering GST on low-esteem imported products is developing at twelve percent a year and this isn’t supportable.

- For what reason weren’t different choices considered for gathering GST on low-esteem imported products?

The seaward enrollment model is the most productive assortment component right now given the constraints of different methodologies. The Tax Working Group was approached to see this issue and they suggested that the Government execute a seaward provider enlistment framework for gathering GST on low-esteem imported products. The Tax Working Group reasoned that different choices for gathering GST on low-esteem imported merchandise are not possible right now.

- What is the joint and a few risk approach received by the United Kingdom?

The United Kingdom acquainted enactment with make electronic commercial centers together and severally at risk for any future unpaid VAT of both United Kingdom and non-United Kingdom organizations emerging from deals of merchandise in the United Kingdom through that commercial center. The measure was planned for handling VAT misrepresentation and mistakes by online venders of products.

Also Read : Flexmls Portal Login

- What amount is the proposed framework expected to cost the Government?

Last expenses of the proposed framework are yet to be resolved, yet given our involvement in seaward provider enrollment for cross-fringe administrations they don’t anticipate that the expenses should be huge.

- Does a $1,000 edge make a hazard to outskirt and biosecurity chance administration?

Right now shippers are required to give data to help powerful and proficient hazard the executives, for example, tax codes, item depictions and other data to empower the recognizable proof of the cause of the merchandise. This won’t change. There are existing punishments for the arrangement of off base data which is likewise not proposed to change.

Customer care:

Get a customer support call on, 0800 227 774.

Reference link:

myir.ird.govt.nz/eservices/home