State Farm 401k Login :

Being a decent neighbor is about something beyond being there when things turn out badly. It’s likewise about being there for the entirety of life’s minutes when things go impeccably right. With energy for serving clients and offering back in their networks, they’ve been doing great by doing useful for very nearly 100 years. Also, they’re cheerful you chosen to become acquainted with them better.

Features of State Farm 401k:

- The State Farm authority group is focused on expanding on their common upsides of value administration and connections, shared trust, honesty, and monetary strength.

- One of the establishing upsides of State Farm is monetary strength. Their new yearly report recounts the narrative of how they’re remaining consistent with that esteem.

- Obviously, they’re not in business to win grants. In any case, it’s ideal to be perceived as a champion organization and boss.

State Farm 401k Login:

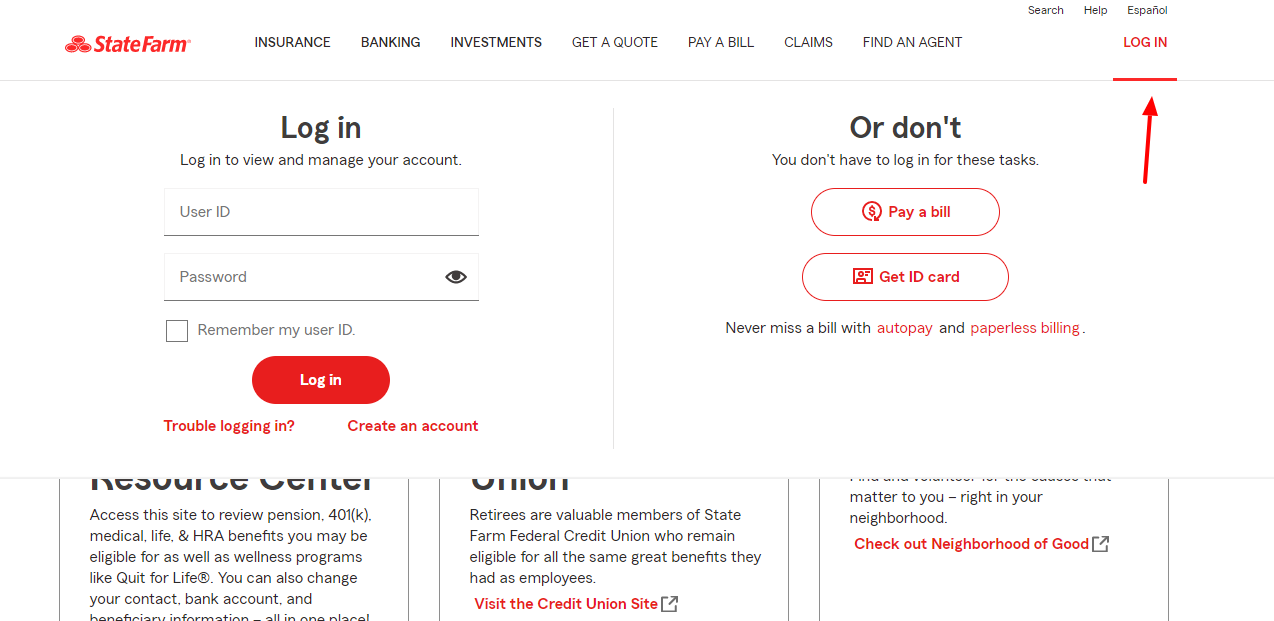

- To login open the page www.statefarm.com/retirees

- As the page opens at top right click on ‘Log in’ button.

- In the login drop down provide, user ID, password click on ‘Log in’ button.

Retrieve State Farm 401k Login Information:

- To retrieve the information open the page www.statefarm.com/retirees

- After the page opens click on, ‘Trouble logging in?’ button.

- In the next screen provide phone number, date of birth, account email, choose your notification method and click on ‘Submit’ button.

Create State Farm 401k Account:

- To create the account, open the page www.statefarm.com/retirees

- Once the page appears click on ‘Create an account’ button.

- In the next screen your name, date of birth click on ‘Continue’ button.

Also Read : Access to Parelli Savvy Club Member Accunt

Tips to Save for Retirement:

- Zero in On Beginning Today: Especially in case you’re simply starting to take care of cash for retirement, begin saving however much you can now, and let build revenue — the capacity of your resources for create income, which are reinvested to produce their own profit — have a chance to work in support of yourself.

- Add to Your 401(K): If your boss offers a conventional 401(k) plan and you are qualified, it might permit you to contribute pre-charge cash, which can be a huge benefit. Let’s assume you’re in the 12% expense section and plan to contribute $100 per payroll interval. Since that cash emerges from your check before government annual duties are surveyed, your salary will drop by just $88.

- Meet Your Boss’ Match: If your boss proposals to coordinate your 401(k) plan commitments, ensure you contribute in any event enough to exploit the match, Greenberg says. For instance, a business may offer to coordinate half of representative commitments up to 5% of your compensation.

- Open an IRA: Consider setting up an individual retirement record to help assemble your savings. A Traditional IRA might be appropriate for you relying upon your pay and whether you as well as your life partner have a work environment retirement plan. Commitments to a Traditional IRA might be charge deductible.

- Mechanize Your Reserve Funds: You’ve presumably heard the expression pay yourself first. Make your retirement commitments programmed every month and you’ll have the chance to possibly develop your savings without considering the big picture. The Merrill Automated Funding Service permits you to computerize customary commitments to your Merrill IRA from one more record at Merrill, Bank of America or other monetary organization.

- Rein in Spending: Examine your financial plan. You may arrange a lower rate on your vehicle protection or save by carrying your lunch to work as opposed to getting it. Merrill has an income adding machine that can assist you with figuring out where your cash is going and discover spots to lessen spending so you have more to save or contribute.

- Put Forward an Objective: Knowing the amount you may need cannot just assist you with bettering why you’re saving, yet additionally can make it really fulfilling. Set benchmarks en-route, and gain fulfillment as you seek after your retirement objective. Utilize the Personal Retirement Calculator to help decide at what age you might have the option to resign.

State Farm Customer Service:

To get further help call on 800-890-2233.

Reference Link: